Welcome to Just Commodores, a site specifically designed for all people who share the same passion as yourself.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Things that p*** you off/bug you/annoy you

- Thread starter RUF-60L

- Start date

Skydrol

Well-Known Member

- Joined

- Dec 4, 2013

- Messages

- 1,043

- Reaction score

- 10,916

- Points

- 113

- Location

- USA

- Members Ride

- Pontiac G8 GT

I do not see that working with a currency. That only works in a super stable utopian economy that runs without any hiccups. Capital has a mind of its own, is like water, it flows where it wants to flow. A good example is the Kondratiev Wave (K Wave). All goes in cycles, some markets are not in sync with the economic tides/currents.This is why the idea one of our finance ministers (in NZ) had many years ago makes sense.

Make retirement saving compulsory for everyone and then instead of using interest rates to slow consumption just increase the amount of saving people put into their retirement funds. And because it effects all people instantly the effects would be seen in spending straight away unlike making changes to interest rates where it takes a long time for it to filter through and at the end of the day the people still have the money for when they get to retirement. It also means people in true hardship can possibly access some of that money so they don't get into real financial strife although if they aren't using interest rates to control inflation the cost of housing would be a lot more consistent.

Some will loose their asses on whatever market they are in, and complaint to the central bank to do something. People are manipulated with feelings, and vote with their wallets, never with their brains.

That is a short term solution to a problem, not to the "problems."

Derekthetree

Well-Known Member

- Joined

- May 19, 2019

- Messages

- 1,174

- Reaction score

- 3,913

- Points

- 113

- Location

- Victoria

- Members Ride

- Gen-F R8 SV Manual

This is such a good idea. Money free to spend goes down which is apparently the driver behind interest rate risesThis is why the idea one of our finance ministers (in NZ) had many years ago makes sense.

Make retirement saving compulsory for everyone and then instead of using interest rates to slow consumption just increase the amount of saving people put into their retirement funds. And because it effects all people instantly the effects would be seen in spending straight away unlike making changes to interest rates where it takes a long time for it to filter through and at the end of the day the people still have the money for when they get to retirement. It also means people in true hardship can possibly access some of that money so they don't get into real financial strife although if they aren't using interest rates to control inflation the cost of housing would be a lot more consistent.

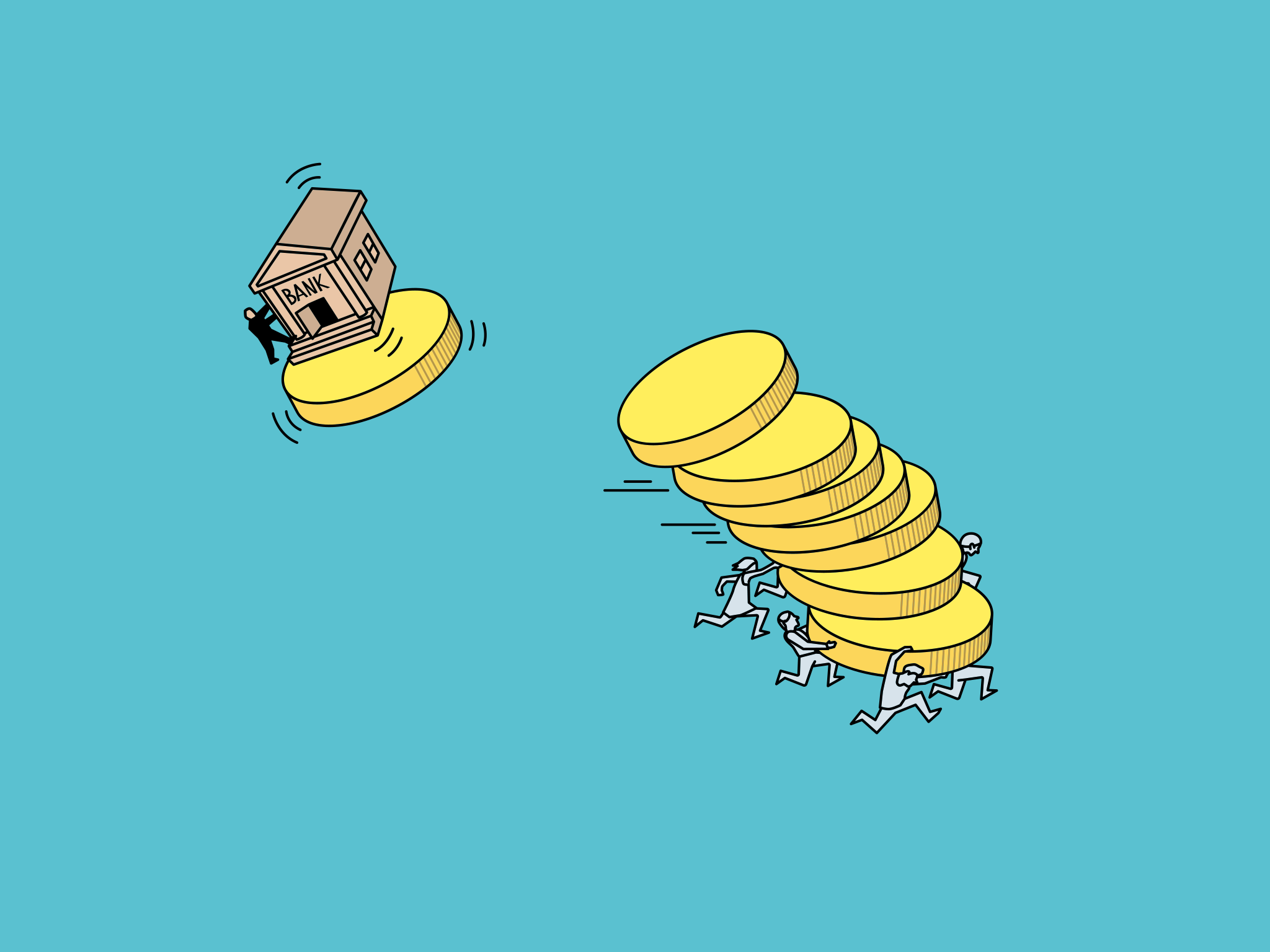

But instead of funnelling money to the banks, it goes to peoples futures.

Hard to implement fairly though, as interest rates hit people in different ways depending on property ownership and earnings.

- Joined

- Apr 15, 2006

- Messages

- 22,673

- Reaction score

- 20,656

- Points

- 113

- Location

- Sth Auck, NZ

- Members Ride

- HSV VS Senator, VX Calais II L67

It's got to be fairer than what we have now where the money goes into the pockets of the banks shareholders.

- Joined

- Apr 15, 2006

- Messages

- 22,673

- Reaction score

- 20,656

- Points

- 113

- Location

- Sth Auck, NZ

- Members Ride

- HSV VS Senator, VX Calais II L67

The ******* cheek of it. A guy breaking the law wants another prosecuted.

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/R4VR6EQ37RH4LLQGLK7IVY4ALQ.jpg)

www.nzherald.co.nz

www.nzherald.co.nz

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/R4VR6EQ37RH4LLQGLK7IVY4ALQ.jpg)

'The car ran straight into me': Dirt biker speaks out after 'appalling' attack on motorist

Woman says she was trying to escape swarm of riders when she went on footpath, struck one.

OldBomb

Well-Known Member

- Joined

- Nov 14, 2022

- Messages

- 291

- Reaction score

- 1,104

- Points

- 93

- Age

- 44

- Location

- Australia

- Members Ride

- VS Berlina

The whole thing is ludicrous. Interest rates should have started rising in 2017. Instead, central bank's decided to leave them on hold or send them into negative territory to appease the likes of Trump, Morrison, Tory conservatives & other ****ers in Europe.

OldBomb

Well-Known Member

- Joined

- Nov 14, 2022

- Messages

- 291

- Reaction score

- 1,104

- Points

- 93

- Age

- 44

- Location

- Australia

- Members Ride

- VS Berlina

I can't be assed. Reason we're in this mess in the first place is because the US decided to print $20 Trillion worth of money. You know because "they control the currency".

Skydrol

Well-Known Member

- Joined

- Dec 4, 2013

- Messages

- 1,043

- Reaction score

- 10,916

- Points

- 113

- Location

- USA

- Members Ride

- Pontiac G8 GT

The reasoning behind is to cheapen the cost of money. The problem they are trying to cover up is the global economic slowdown. The 2008 bank crisis did not went away, was papered over by absorbing into the gov all the toxic assets.The whole thing is ludicrous. Interest rates should have started rising in 2017. Instead, central bank's decided to leave them on hold or send them into negative territory to appease the likes of Trump, Morrison, Tory conservatives & other ****ers in Europe.

When the cost of the currency is 0 corporations take advantage like drunken sailors pouring gasoline into the fire to put it out.

That did not solved the issue, only postponed the inevitable.

Central Banks are out of ammo. What needs to happen is to let it all crash, there is no other way, there is no fixing. This is the end my friend.

The idea came from an idiot called Ben Bernanke that won a Nobel Price for the shît-show that we are watching now.

Ben Shalom Bernanke[2] (/bərˈnæŋki/ bər-NANG-kee; born December 13, 1953) is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014.

The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2022

The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2022 was awarded jointly to Ben S. Bernanke, Douglas W. Diamond and Philip H. Dybvig "for research on banks and financial crises"

Skydrol

Well-Known Member

- Joined

- Dec 4, 2013

- Messages

- 1,043

- Reaction score

- 10,916

- Points

- 113

- Location

- USA

- Members Ride

- Pontiac G8 GT

Not the " US", is the Fed Reserve that is not Federal and has no Reserves. Is a private bank that has owners and pay dividends to the board members. The US Congress borrows the currency in credit with Treasury Bonds, and they go out and spent it on all sorts of pork, social programs and wars.I can't be assed. Reason we're in this mess in the first place is because the US decided to print $20 Trillion worth of money. You know because "they control the currency".

Now they are asking for an increase of that line of credit "debt ceiling." If not, the gov have to make ends meet with last years budget.

The banks and the gov do not get to use the Cantillon Effect, and have to work with devalued currency. That is why the whole scare/crying of the gov shutdown is all about.

Since the USD is the global reserve currency, whatever the Fed Res does it does affect the world.

Last edited: