The benifit of leasing depends on an individuals circumstances and desires. The bottom line depend on vehicle cost, salary, how many kms they do each year and how many years they lease for. What they get and what it costs defines whether its a goer....

If you are paid $ 1/4 mil a year and lease the cheapest Ferrari @ $399,988 for 2 years, you'll only see a $1500-$ 1600 monthly impact. That's less than $40k to drive a $400k Ferrari for two years... Some may consider that great value...

As always money is king... and as Mel brooks said, its good to be king

Sadly, the rip off is to the public purse which carries the cost of such extravagance which, now that manufacture is dead, can only benifit the vehicle importers.

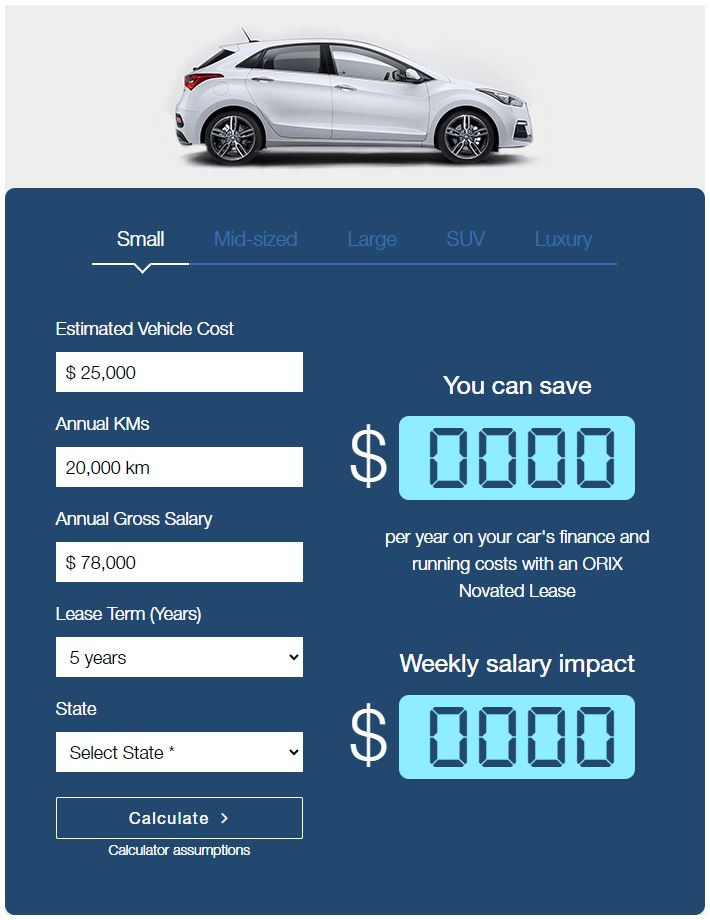

For the curious, see this novated lease calculator and play with the prospects of being very well paid...

[/URL]